Financial Modeling

Financial Project Overview

1. Introduction to Company

Company is a key player in the agricultural and fertilizer industry, providing essential products and services to support agricultural development in West Africa. The company operates in a dynamic and competitive environment where it serves a wide range of customers, from small-scale farmers to large agribusinesses. Company’s operations span production, distribution, and sales of high-quality fertilizers and related agricultural products, contributing to both local food security and economic growth in the region.

2. Key Products and Services

- Fertilizers: Company offers a wide range of fertilizers, including nitrogen-based, phosphate, and potassium-based products, tailored to various crops and soil conditions.

- Agricultural Support Services: The company provides advisory services, helping farmers optimize their use of fertilizers and improve crop yields through best agricultural practices.

- Distribution Network: Company operates a robust supply chain, ensuring timely delivery of products across key agricultural regions.

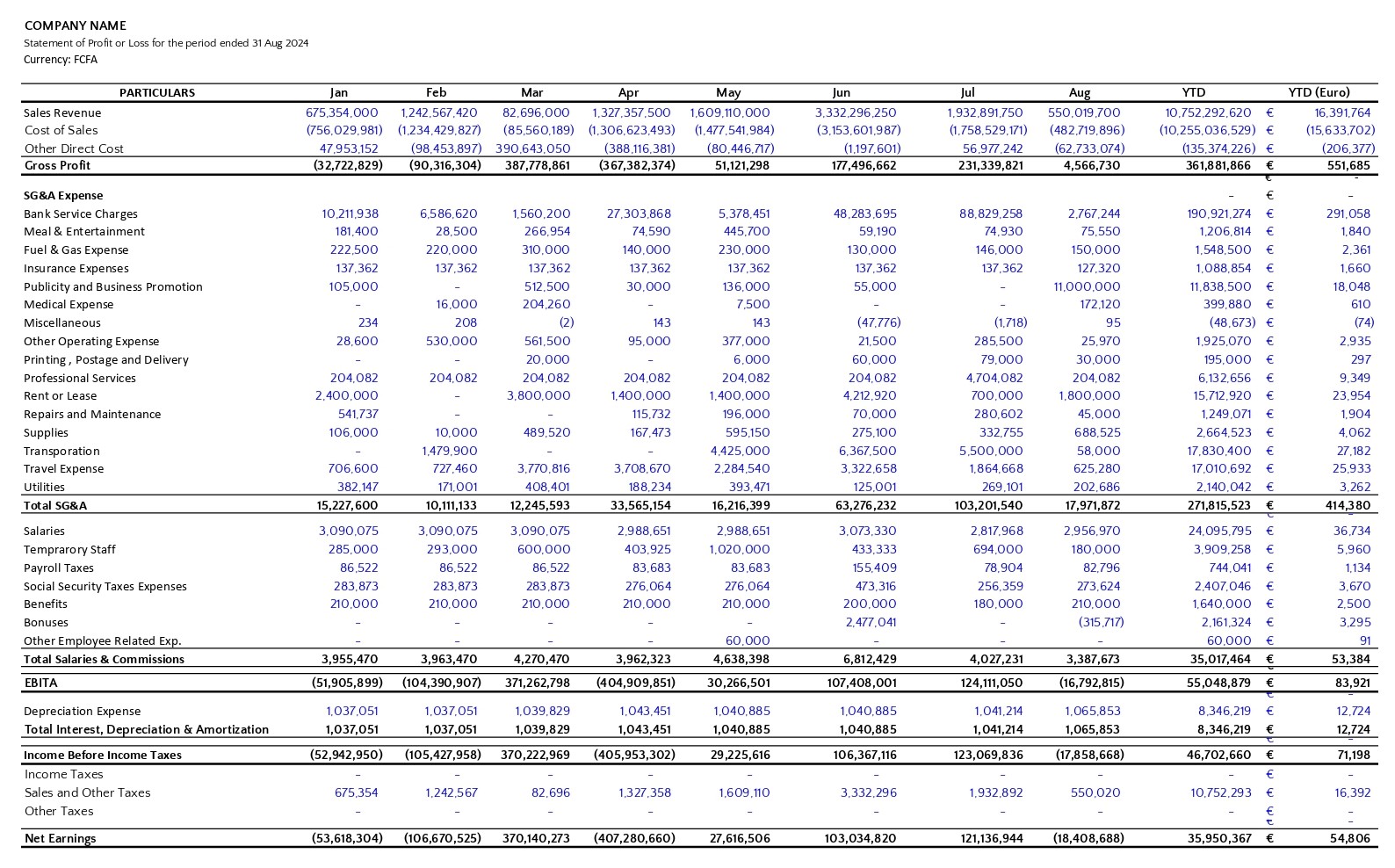

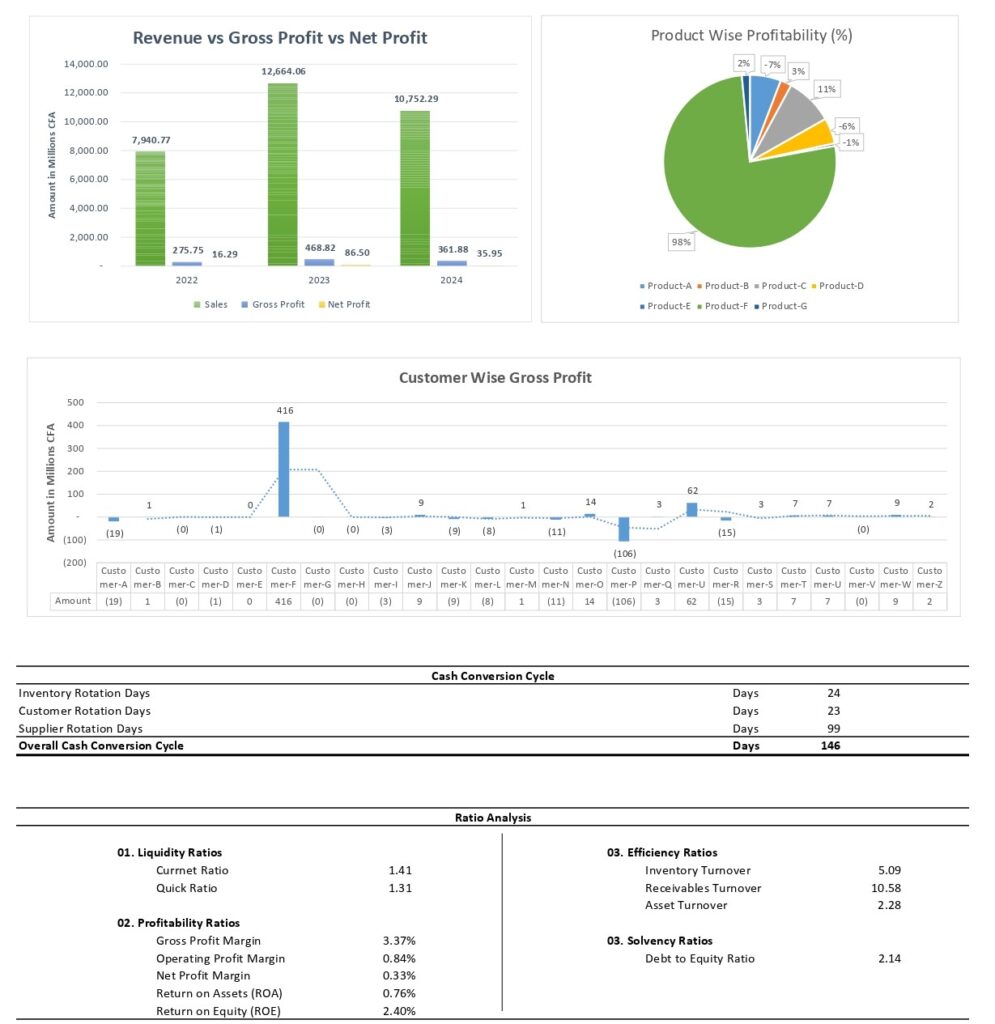

3. Financial Performance Overview (Jan–Aug 2024)

The financial performance of Company has been solid in 2024, despite challenges related to market volatility and operational costs. The company has shown resilience and adaptability, maintaining strong sales performance and prudent cost management.

Key Financial Metrics:

- Total Revenue (YTD): FCFA 10.75 billion (€16.39 million).

- Sales Growth: Company experienced significant revenue growth in April (FCFA 1.33 billion) and June (FCFA 3.33 billion), marking these months as pivotal in driving year-to-date (YTD) performance.

- Net Profit: The company’s profitability has remained stable, supported by effective cost control and operational efficiency.

4. Business Segments

- Production: Company operates advanced production facilities that ensure a continuous supply of fertilizers. The company focuses on both domestic production and the import of high-quality raw materials.

- Sales and Distribution: The company has a wide-reaching distribution network that spans several countries within the West African region. Its logistical efficiency enables it to meet the demands of agricultural businesses quickly and efficiently.

- Customer Segments: Company serves a diverse customer base, including:

- Small and medium-sized farmers.

- Large agribusinesses and cooperatives.

- Governmental and non-governmental organizations involved in agricultural development.

5. Market and Industry Position

Company operates in a highly competitive market but has established itself as a leader in the fertilizer industry through its:

- Strong Brand Reputation: Known for delivering quality products and reliable services.

- Customer Loyalty: The company has built long-term relationships with key customers, based on trust and consistent performance.

- Innovation: Continuous research and development (R&D) have enabled Company to introduce new products that meet the evolving needs of modern agriculture, contributing to higher yields and sustainable farming practices.

6. Operational Efficiency

Company has focused on improving operational efficiency by:

- Optimizing Production Costs: Reducing material wastage and streamlining production processes have helped lower the cost of goods sold (COGS).

- Logistical Improvements: Investments in distribution infrastructure have shortened delivery times, minimized transportation costs, and ensured timely availability of products.

- Cost Management: Careful control of operating expenses, such as administrative costs and wages, has resulted in steady operating income.

7. Challenges and Opportunities

Challenges:

- Rising Raw Material Costs: The global volatility in raw material prices, particularly for nitrogen and phosphate, has put pressure on the company’s margins.

- Currency Fluctuations: Exchange rate fluctuations between the CFA franc and the euro may impact international trade and profitability.

- Market Competition: Increased competition from both local and international fertilizer suppliers presents a challenge to maintaining market share.

Opportunities:

- Expansion into New Markets: Company is exploring opportunities to expand its operations into neighboring countries and untapped agricultural regions.

- Product Innovation: The company is developing new fertilizer formulations that are more efficient and eco-friendly, catering to the growing demand for sustainable agriculture.

- Government Initiatives: Supportive agricultural policies and subsidies provided by the government create growth opportunities in the local market.

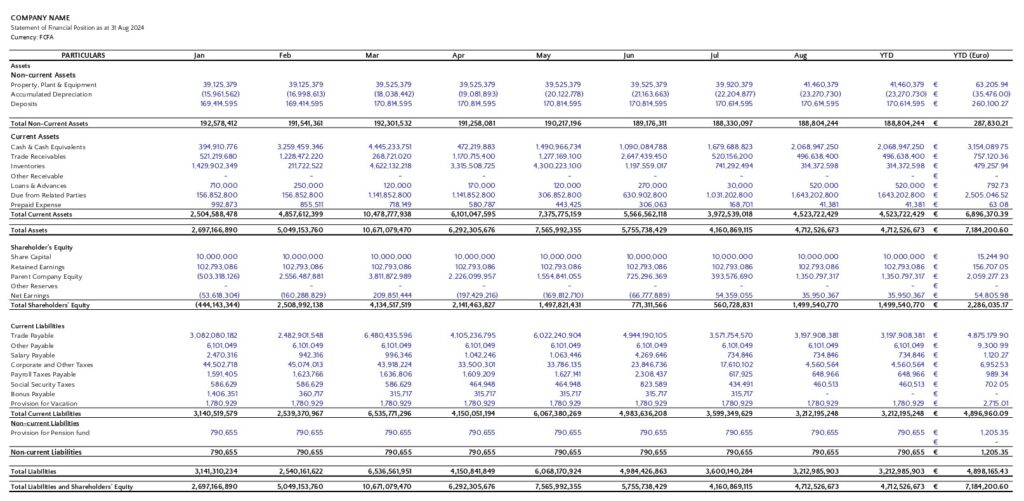

8. Financial Summary (Jan–Aug 2024)

Company’s financials reflect a company that is managing its resources effectively while capitalizing on growth opportunities in the agricultural sector.

- Revenue: Strong revenue growth has been a highlight, driven by consistent sales performance.

- Profitability: The company’s profitability has been stable, with margins remaining healthy despite challenges from rising input costs.

- Balance Sheet: Company has maintained a balanced approach to asset management, with significant investments in inventory and receivables to support future sales growth.

9. Future Outlook

Company is well-positioned for continued growth in 2024 and beyond, supported by its strong market position, expanding product portfolio, and commitment to operational efficiency. Key focus areas for the remainder of the year include:

- Strengthening the supply chain to mitigate the impact of rising material costs.

- Expanding into new geographic markets.

- Introducing innovative, eco-friendly fertilizer solutions to meet the growing demand for sustainable agricultural practices.

Project summary :

The financial analysis of Company (Jan–Aug 2024) has provided a comprehensive understanding of the company’s financial performance, operational efficiency, and strategic direction. The key outcomes from the project are:

Detailed Financial Insights: The project provided an in-depth look into Company’s revenue streams, cost structures, profitability, and financial position. This included a breakdown of key metrics such as sales growth, net profit margins, asset management, and debt levels.

Identification of Strengths and Weaknesses: The analysis highlighted Company’s ability to generate significant revenue and maintain profitability, while also pinpointing areas for improvement, such as rising raw material costs and operational expenses.

Strategic Recommendations: Based on the findings, strategic recommendations were made to enhance profitability, improve liquidity, and optimize debt management. These recommendations aim to ensure the company’s financial sustainability and growth.

Foundation for Future Decision-Making: The project has laid the groundwork for more informed decision-making, particularly in areas such as cost control, debt management, and market expansion. This will enable the company’s leadership to make data-driven decisions that will improve both short-term and long-term performance.

The financial analysis project delivers multiple benefits to Company:

Improved Financial Visibility: The detailed breakdown of revenue, costs, assets, and liabilities gives the company a clearer picture of its financial health. This increased transparency allows for more effective financial planning and control.

Enhanced Profitability: By identifying cost-saving opportunities and areas for efficiency improvement, the company can implement strategies that will directly impact its bottom line. Lowering operational expenses while maintaining sales performance will boost profitability.

Optimized Debt Management: With a thorough understanding of the company’s debt levels and repayment structure, the company can explore refinancing options or debt restructuring to reduce interest expenses and improve financial flexibility.

Strategic Growth Opportunities: The analysis has opened up pathways for growth by highlighting opportunities in new markets and the development of innovative products. This positions Company for expansion and increased market share in the coming years.

Risk Mitigation: The project has identified key risks such as rising input costs and market competition. By addressing these risks early, the company can mitigate potential financial impacts and safeguard its profitability.

Support for Decision-Making: The financial insights and recommendations from this project will serve as a key resource for the company’s leadership (CFO, CEO) to make well-informed strategic decisions that align with the company’s goals.

Long-Term Financial Planning: Company now has a stronger basis for long-term financial planning, with actionable insights into how to manage its capital structure, optimize resources, and maintain steady growth.

In summary, the financial analysis project equips Company with the tools to enhance its financial performance, manage risks, and capitalize on growth opportunities, driving both short-term success and long-term sustainability.

Client Details

Client details are confidentiel

Service Provided

Financing, Marketing, Tax Advising, Consulting

Project Timeline

Our Expert Team took one month for com